I witnessed a glimpse into the future

My first ever Tesla stockholder meeting

Last week I posted the YTD results of a portfolio I started overseeing in January that originally held 1,818 shares of Tesla which effectively represented a whopping ~140%(!!!) concentration. This led me down a certain rabbit hole to determine what kind of position in TSLA 0.00%↑ would be appropriate for the portfolio which of course begins with examining the company and where it’s headed. While I know people with Tesla cars, I’ve never personally owned or even operated one (or any of their other products like the solar roof for that matter).

If I’m not familiar with any of the products/services, it’s very difficult to analyze…well anything about the company. To make things worse, I was quickly hit with something I’ve never even heard of before in my years of investing and trading. As I followed the news regarding Tesla, a compensation package for Elon Musk the CEO was valued at ~$55billion (with a B) and it was also being contested.

How did we get here? This compensation package was originally agreed upon in 2018 based on a 10 year performance. It was a 100% at-risk compensation metric that had zero salary and zero equity unless Tesla achieved a minimum 100B market capitalization (Tesla was valued at ~$50B at this time). If this along with other operational metrics were met, 1% of outstanding shares per 50B above the 100B market cap would be awarded. Turns out Elon effectively did the impossible and performed so well that Tesla’s market cap grew to a current value of over $500B and it hasn’t even been the full 10 years. However, a certain Tesla shareholder believed this to be too much and a judge agreed. In late January of this year, the judge ruled against Elon’s pay package. (I’m not a legal expert but I view this as an insane overstep of judicial authority).

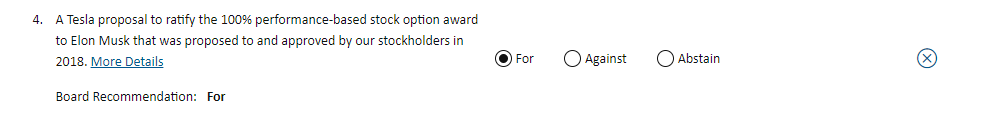

Fast forward to this past week, Tesla held the annual shareholder vote to determine among others, the compensation package for Elon to contest the ruling. As a person who takes risk for the right rewards, you bet I voted FOR:

In the end, the owners (with the help of a woman by the Twitter handle of @TeslaBoomerMama rallying retail shareholders) collectively made their voice clear: reaffirm the compensation package deal that retrieved enormous returns for Tesla shareholders because undertaking risk and delivering banging results should be handsomely rewarded - a deal is a deal. With this vote Tesla also relocates to Texas following the judicial nonsense from Delaware.

In the stockholder meeting following the results, the jubilation of both Elon Musk and Tesla shareholders was an absolute spectacle. See the full video below (Elon shows up around 45 mins in)

As I viewed the Tesla shareholder meeting for my very first time, I was invited to share in the vision of an incredibly bright future for humankind: a world with clean energy, autonomous driving / robotaxis (which I hope and believe will eventually eliminate vehicular deaths outright), and even an in-home robot (Optimus) like a personal C3PO/R2D2. Not only are these prospects incredibly exciting, this is all possible within the next decade.

The simple fact of the matter is: Tesla is not where it is today without Elon and Tesla is monumentally better with Elon at the helm. While I see the bulk if not all of the value of ownership in gains, it’s not always about the money. This week reminded me that at its core, it is about having a voice in the direction of the company with a literal vote.

If I’m going to join a cult, I’m fully embracing Tesla and voting with my dollar: I hold long term options for TSLA 0.00%↑ and expect Elon Musk to become the first ever trillionaire in human history as Elizabeth Warren seethes.